7 Simple Techniques For Loss Adjuster

Table of ContentsLittle Known Questions About Loss Adjuster.Some Known Details About Public Adjuster The 6-Second Trick For Loss Adjuster6 Easy Facts About Public Adjuster ShownPublic Adjuster Can Be Fun For Anyone

When managed by an accredited case specialist, many property owners and commercial insurance policy claims can be settled effectively as well as without the demand to submit fit. Currently you understand the solution to the concern: What does a public insurance adjuster do? If you have an insurable loss, it's crucial to hire a public insurance coverage adjuster to make sure that you obtain fair and also complete compensation.Called one of the leading Public Insurance coverage Adjusters in the Southwest, Jim O'Toole got his begin in 1976 at the young age of 17. He discovered the insurance claims readjusting service at the heels of his dad James O'Toole Sr.

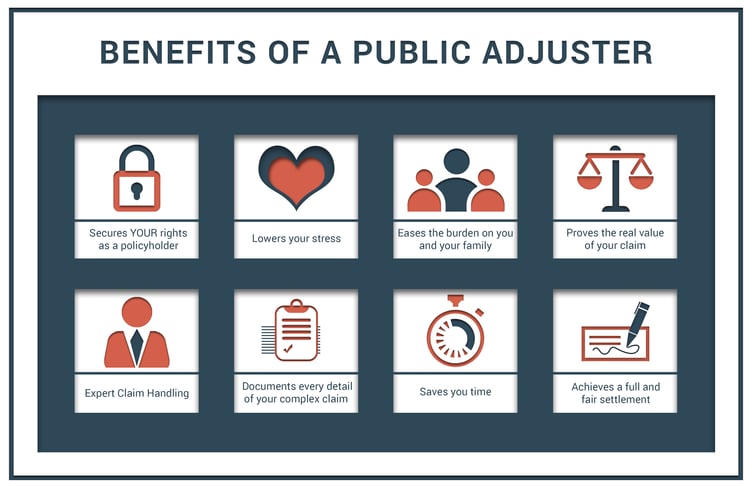

Researches have plainly shown that one of the most stocks put together by guaranteed without the assistance of the public insurer are very insufficient. A: A public insurer is an insurance coverage claims insurance adjuster who promotes for the policyholder in appraising and bargaining an insurance case. A public insurance adjuster is the only kind of insurance claims adjuster that can lawfully represent the legal rights of a guaranteed throughout an insurance coverage claim procedure.

The smart Trick of Property Damage That Nobody is Talking About

It would be a severe offense for any type of insurer to differentiate versus you by any means for working out an appropriate provided to you by the State of Florida. A: Normally, it is not far too late. Florida regulation enables a couple of years to file a supplementary claim from the date of loss.

We will thoroughly examine and examine your case and give you our expert opinion (property damage). A: The insurance coverage firm insurance adjuster or independent insurance claim insurer are both used by the insurance provider as well as can't shield both your rate of interest as well as the rate of interest of his/her employer at the very same time. The insurance provider adjuster will certainly commonly provide to work out a claim for the sum they choose, which is not always for the insurance holder.

As soon as an individual has actually experienced the benefits of our solutions, they will hardly ever try to resolve a claim without our aid. A: You need to call us immediately after a loss. It is most useful for all parties when we are included at the beginning of the claim growth so we can establish the see here tone for the whole procedure.

These costs are controlled by the Florida Division of Financial Services. A: Yes! Much of our clients were informed their claim was rejected. We merely reopen the loss, bargain with your insurer, as well as insist they spend for sensible problems.

Property Damage Fundamentals Explained

The loss problems satisfy the requirements for insurance coverage. The negotiation amount required to bring back the policyholder's building to pre-loss condition. Any type of idea that confirming these things is simple, or that a computer system can do it for you, is incorrect. Claims get untidy in a rush, typically since the: Policy language is unknown, difficult to understand, and also based on interpretation.

With a degree having fun area, plentiful documentation, as well as verifiable proof of all assessments, it ends up being really tough for the insurance policy company to argue for anything much less than a full and also fair negotiation.

Our work is made complex. You, our customers, are confronted with worry, despair, anxiety as well as a host of other feelings. Our group can be found in as your consulting partner. We assist you manage the feelings, to ensure that we can concentrate on our work of making best use of the results for your cases of building loss.

Property Damage Things To Know Before You Buy

Your insurance provider will undervalue your claim and stays in business to pay out the very little amount of damages. Our payment is driven by the negotiation of the claim. The settlement that we make every effort to make certain is the maximum quantity available within the confines of your insurance coverage find more information policy. Clarke & Cohen settles your insurance coverage claim with the most equitable settlement in the least amount of time.

We function mainly in the Philadelphia area as well as the New Jacket shore, yet have cleared up claims throughout the country and also the Caribbean for decades. When you need to submit an insurance policy case, the complete obligation of preparing the claim falls upon you, not the insurance provider. Nevertheless, when you submit this case without help, you might miss out on essential info that would certainly have worked to your monetary benefit.

We function as your advocate throughout the complex procedure of insurance coverage case negotiation.

The 25-Second Trick For Public Adjuster

Compared to an insurance adjuster worked with by the insurance provider, you stand a much better possibility of getting a fair negotiation with the public insurer. However, public insurers can be pricey, and their costs (typically 10-20% of you declare) might not always deserve it for you. While a public insurer knows Florida's statutes concerning residential property insurance coverage claims, they don't exercise legislation and have no experience confronting insurance coverage firms when a lawful disagreement develops as well as must be taken to court.